The first, independent research from cleantech insiders into the charge point planning ecosystem...

After recently investing in Dodona Analytics, Flashpoint Venture Capital reviewed the EV charging landscape and concluded that there is a “huge” market potential. We highlight some key takeaways from this analysis, the market´s drivers and current challenges.

The Electric Vehicle (EV) space is set to explode in the very near future, and with it, EV charging. Already, consumer adoption in wealthy economies such as the US, China, UK and Europe is up and still climbing.

The key driver behind this is of course the desire for lower carbon emissions, but the average consumer will also soon be driven by the fact that EVs will become a more financially viable option. Consumer anxieties surrounding current drawbacks such as range and performance are also set to be much reduced thanks to technological innovations looking to achieve parity with regular vehicles (Internal Combustion Engines, ICEs) by 2050.

Fully Electric by 2030

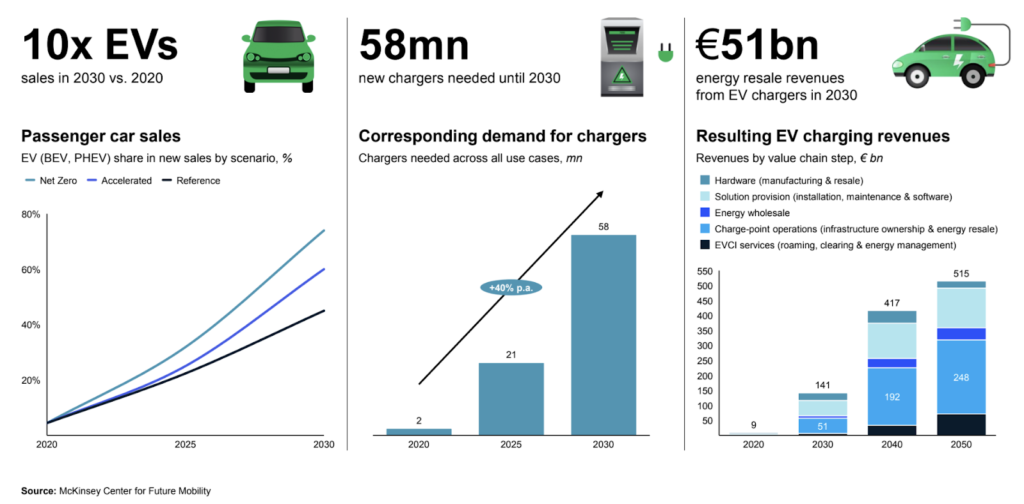

Thanks to the desire for lower carbon emissions, various regulations are incentivising the production of EVs across the wealthier economies in the world, with the intention of phasing out ICEs altogether. Consequently, car manufacturers are shifting production focus to EVs, with some aiming to only produce EVs by 2030.

Accompanying Infrastructure

The charging infrastructure required to support such a shift is monumental. EV charging needs are complex, with EVs requiring different charge types according to their driver’s activity and destination.

But with most cars sold by 2030 being fully electric, Flashpoint states that around 58 million new chargers will be vital in keeping us on the move and of course.

There are three main types of charger:

- AC chargers (<22kW): a very slow charge of around 8+ hours, cheap for the user

- Slow DC chargers (22-80kW): a faster charge of between 2 – 4 hours, more expensive for the user

- Fast DC chargers (80-150kW): high-speed charge points, taking less than an hour to fully charge a car, expensive for the user. HPC (High-Power Chargers) offer an even faster charge with 150kW of power.

How and where do people currently charge their cars?

At home – 65% of current charger numbers and using AC charges, these are mostly found at single family homes and new multi-family apartments

At work – 10% of current charger numbers, these mostly use AC charges as vehicles are able to recharge over the course of the working day.

Public street chargers – Between 5 and 10% of total charger numbers, these are slower charge points mostly using AC charges where a resident could leave their car for long periods of time.

Public Point Of Interest (POI) chargers – Making up 10% of chargers and usually placed at locations such as restaurants, shopping centres, supermarkets etc., users require a faster charge. These charge points often offer a mix of AC and DC chargers.

Public on-the-go-chargers – These form 5% of the charging landscape and are aimed at drivers requiring a full charge in under an hour – found at locations such as fuel stations and charge hubs.

Fleet hubs – Currently making up 5% of the charging landscape, these hubs service commercial vehicles and offer a variety of AC, DC and HPC chargers.

According to McKinsey, Public on-the-go chargers and charge points are currently the most absent from the current EV charging infrastructure. This presents a huge opportunity – one with revenues of 51 billion euros to those involved in the production, installation and operation of these chargers.

Let’s take a look at the key players typically involved in such a process:

- Charge Point Operators (CPOs): companies which plan, install and operate the Charging Point or station

- Charging Station Owners (CSO): the economic beneficiaries of the revenue generated by the chargers, often the same company as the CPO

- Charging Point Analytics: technology used by CPOs to identify and plan charge point locations

- Mobility Service Providers (MSPs): those who facilitate the charger payments, usually between the user and the CPO, with user payment information being stored with them either via an app or charge card

- Roaming Platforms: these companies can link MSPs and CPOs, enabling EV drivers to charge at any charger regardless of its operator and MSP

- Electricity Suppliers: supplying the energy and electricity grid, usually a public or state provider

Challenges

These companies and outlying service providers are in an exciting position, but they also face some sizable challenges.

Payment

Most charger payments are facilitated by MSPs, requiring the user to register with a payment app or use a charge card. According to gridX, users would much prefer using their own payment method. A concept called “Plug & Charge” is looking to enable EV drivers to pay automatically while charging but this requires tight coordination between key value chain players and is currently not a common option.

Bureaucracy

The red tape surrounding the complex process of setting up charging points is a big challenge for CPOs, and one which could eventually slow down EV adoption .

Peak Time

Although it is likely that charging hubs will be most successful if they are home to a mix of AC and DC (slower and faster) chargers, according to gridX, DC chargers are predicted to win out when it comes to the most common charger type, as they mean bigger financial wins for CPOs and other associated parties. But this will create big challenges around energy management during peak charging times.

Heavy Duty Vehicles

Larger vehicles must also be catered for by the evolving EV charging ecosphere and will be a particularly big energy challenge (no pun intended). CPOs must also cater for needs such as the data flow between the vehicles and freight operator scheduling systems.

“Range Anxiety”

Battery performance is a big concern for the industry. Not only do EV batteries wear out but also have a reduced performance in cold weather. As a result, certain areas will require a heavier saturation of charging stations, with widespread cover still needed to secure consumer confidence.

Investment in the EV Charging Space

As a relatively new and evolving market there is a high number of start-ups in the space.

While CPOs are quite literally getting the charge points up and running, it is battery technology that is currently pulling investor interest as a solution to the challenges presented by a fully-fledged electric vehicle ecosystem.

CPOs are coming in second for funding interest, with analytics solutions being one of the least funded areas in the landscape, alongside MSPs. These younger companies and their technologies have not yet gained enough traction to attract large investment interest.

That’s our take, you can read more at Flashpoint- An Overview of the EV Charging Landscape.

Subscribe Here!

A marketing professional and content producer of almost 10 years, Lucy has helped steer marketing strategies across a variety of B2B industries, and now applies her research skills to the EV industry.

You can follow Lucy Campbell-Woodward on LinkedIn

.png?height=200&name=CPPPromoBlog%20(1).png)